Can a trade war trigger a recession?

MSU Denver Economics expert explains how tariffs are roiling global markets and what you can do to protect yourself.

Global markets are in turmoil. A high-stakes trade standoff between the United States and China has triggered policy whiplash, spooked Wall Street and left consumers bracing for economic fallout.

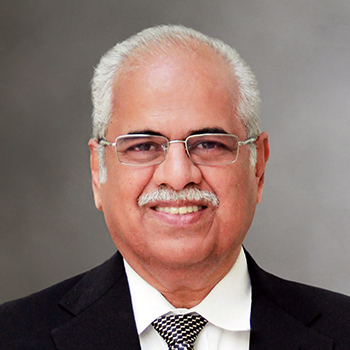

As the two economic giants exchange escalating tariffs, the ripple effects are being felt far beyond trading floors. Whether it’s inflation or job insecurity, U.S. consumers, including college students, are facing growing uncertainty. Kishore Kulkarni, Ph.D., professor in the Department of Economics at Metropolitan State University of Denver, says this is one of the most turbulent periods he has seen in decades.

“I’ve been observing the U.S. economy for 50 long years,” said Kulkarni. “I have not seen a more dynamic and more volatile economic situation created by a policy change than we have been going through in the last two weeks.”

The volatility began when the U.S. imposed sweeping tariffs on imports from nearly every major trading partner. After the stock market reacted with a steep selloff and concerns mounted over the U.S. bond market, the tariffs were paused for 90 days. China, however, remained the exception. In response, the country imposed its own set of heavy counter-tariffs.

Blanket tariffs such as these can slow the economy by raising consumer prices, which leads to reduced spending and, ultimately, higher unemployment. “Clearly, when consumers lose, all of us lose,” Kulkarni said.

RELATED: ‘Tariffs aren’t the answer’

5 ways to protect your budget during a trade warBuy generic when possible. Shop at discount or bulk stores. Cut back on discretionary spending. Track your inflation exposure. Focus on long-term financial goals.

|

|

For students living on tight budgets, the effects could be even more pronounced. “All economics is about choices, so they have to be economical in terms of their behavior,” he said.

Kulkarni recommends a few steps to minimize financial risk during uncertain times: Opt for generic medications, shop at budget stores, and consider cutting back on discretionary purchases. These cost-cutting strategies may help if inflation stays below 10%, he said.

But not everyone will lose in a downturn — those who can save may benefit.

“If you are in an income bracket where you can pay all your bills and still save some of your salary, then this is an excellent opportunity to buy some real assets, as well as financial assets,” Kulkarni said. “Economic crises have always benefited the rich more than the poor because the rich have some spare change to buy up assets.”

Globally, Kulkarni believes countries such as India may be well-positioned to weather the storm. With only 5% of its gross domestic product tied to exports, India is relatively insulated from international trade disruptions. “When China gets into a fight with the U.S., companies will go to India to find an alternative,” he said.

Still, Kulkarni hopes U.S. leaders will course-correct.

“As we all know, there are new signals and policy changes happening on a daily basis,” he said. “What is going to happen in the future is unknown, especially now because we don’t have any steady change in the policy.”