Fighting crime by crunching numbers

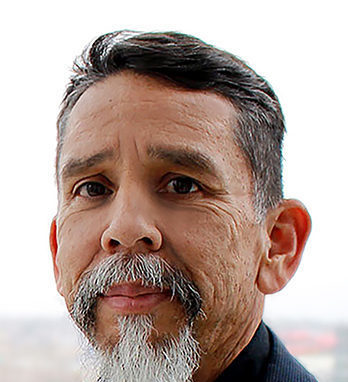

IRS Special Agent Karen Gurgel is showing a new generation of accounting majors how to fight white-collar crime.

Think of Karen Gurgel as a jigsaw-puzzle master.

Often the pieces comprise financial records, but they also include information obtained through interviews, wiretaps and surveillance.

The veteran Internal Revenue Service special agent pieces together records to complete a picture of white-collar crimes and bring charges against their perpetrators: financial violations, tax fraud, money laundering, racketeering and more. And through her work with the IRS’ Adrian Project, she’s showing Metropolitan State University of Denver accounting students how number-crunching can fight crime.

“One of the best things about our job is we follow the money. While it can be a little crazy at times, it’s fascinating to be able to see how someone can go completely off the radar,” said Gurgel, who in 2018 earned a master’s degree in professional accounting from MSU Denver after nearly 20 years with the IRS. “When you start digging through it, it’s like this trail they leave behind for you to follow. I love it. It’s like a jigsaw puzzle. I’m trying to figure it out and piece it all together.”

In a recent case, for instance, an extensive investigation led by Gurgel resulted in the conviction of a person for tax evasion and failure to file personal and corporate tax returns. By putting the pieces together, Gurgel’s team learned the person had multiple residences in Colorado – including a ski house – as well as two condos in Hawaii, all without reporting income since the mid-1990s.

Recognizing the need for accounting professionals in its criminal-investigation division, the IRS in 2002 developed the Adrian Project with the Accounting Department at Michigan’s Adrian College. Over the past 18 years, the workshops have spread to institutions around the country; Gurgel worked with MSU Denver accounting Professor Doug Laufer, Ph.D., to bring Adrian Project workshops to the University in 2010.

During the workshop, student-participants receive a mock case that is based on of a real-life scenario. Depending on the case, students will conduct interviews and surveillance, go undercover and analyze financial records and tax records. Students then have to go in front of a judge, where they have to recap their case, what their probable cause is, why they think a person committed a crime and why they think they should be granted a search-and-arrest warrant. The simulations are all led by former or current IRS special agents, including Gurgel.

“One of the reasons I enjoy the Adrian Project is because (IRS special agents are) a small group of people whose jobs are very important, but our name isn’t out there as much as other agencies. It’s important to be able to go out there and say what we do and what we’re capable of doing,” said Gurgel.

The latest iteration of the Adrian Project for MSU Denver accounting students was scheduled for April 3, but has since been cancelled due to COVID-19 concerns. The University will work to bring it back on campus in upcoming semesters. In past years, the IRS has told participating students to watch out for special-agent openings, but this year the IRS will have a special-agent open position that can be applied for throughout the entire calendar year.

“When we do an Adrian Project, we’re getting students thinking about a profession that serves the community but also their accounting and business skills to better society,” said IRS Special Agent Andy Tsui. “It’s an opportunity to get the message out to students so they can also spread the word that it’s a rewarding position that some might not be aware of.”

The hope, Gurgel said, is that a new generation of accounting students will take up the challenge fighting white-collar crime instead of just “falling into it,” as she did.

Growing up in California, Gurgel needed to fill an extra class during her junior year of high school. Her father advised her that since she liked numbers, she might try an accounting class. She took the class, loved it and went on to study accounting at San Diego State University. One day, an IRS agent spoke to her class about opportunities for accountants. Gurgel still remembers filling out the paperwork and receiving a package in the mail about IRS criminal-investigation opportunities.

“I was like, ‘Why not? Let’s try this,’” she said. “My husband supported me and told me to go for it, and that just got the ball rolling – they hired me, and it’s been 20 years now.”